Interest in workflow automation is at an all-time high. According to a recent survey, 80% of executives are planning to increase spending on automation initiates in 2022 and 72% are looking to shorten the timeline for automation initiatives.

Financial and accounting operations are an ideal candidate for workflow automation as accurate and timely reporting, spending approvals, financial control, and compliance requires the time consuming and error-prone coordination of people - across departments, legal entities, and time zones - and data - from spreadsheets, ERP, and other operational systems. With remote and hybrid workers, knowing where things stand and ensuring it all gets done now takes even more effort, causes more frustration, and further increases personal exposure.

Although ERP systems, packaged financial applications, and document management systems all have workflow automation capabilities, most companies find them too rigid, inadequate, and unusable – particularly by non-accountants. Getting these fragmented systems to work together as end-to-end solutions involves multiple lengthy and expensive development projects that often fail and add another layer of technical debt. Instead, the focus has been on automating simple repetitive tasks using RPA.

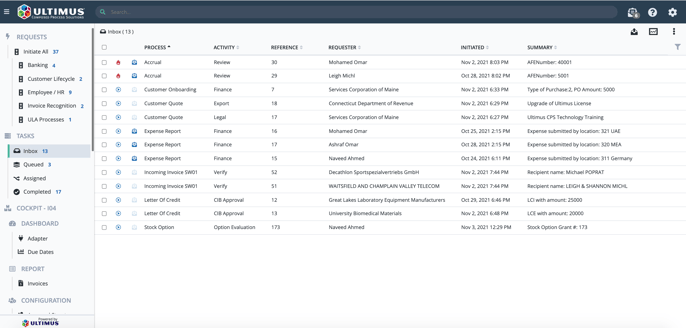

Ultimus Portal provides users with a consolidated task list.

Ultimus Portal provides users with a consolidated task list.

Now that RPA has exhausted its low hanging fruit, finance innovators are again turning their attention to the bigger value provided by automating critical processes. These processes are not only numerous and complex, they require the orchestration of complementary automation technologies like machine learning.

That’s where the Ultimus Digital Process Automation Suite comes in. The Ultimus DPA Suite, called “one of the most comprehensive and well-thought-through digital process management systems on the market”, is designed to simplify and accelerate the implementation of otherwise costly processes. Ultimus DPA Suite’s composable architecture allows business users to configure its extensive array of pre-built solution elements into families of consistently built, flexible, and interoperable end-to-end workflow solution families.

Finance and accounting processes automated with the Ultimus platform include:

- AI Invoice Processing and Approval

- Accrual and Deferral Management

- Month End Financial Closing Management

- Petty Cash Requests and Settlement

- Vendor Onboarding

- Travel Authorization and Expense Reimbursement

- Discount, Refund, and Write-off Approvals

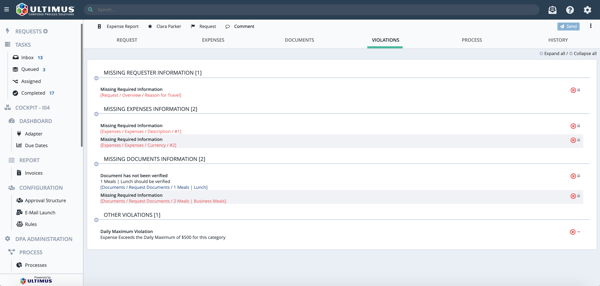

Built-in validations reduce user errors.

Built-in validations reduce user errors.

But Ultimus is about more than just technology - we are about customer success. Our experts work hand-in-hand with customers to deliver the key early wins that make it easy to justify more and more automation, in essence transforming your digitization journey into a self-funding cash cow.

The best way to start? A free Proof of Concept. An Ultimus POC allows you to see and use your business process with your requirements in the form of a functional application. You can see how quickly a solution can be put it in place, how well it works, and whether it meets your ROI hurdle.