Digital Process Automation for Banking and Finance

Realize Digital Transformation

Ultimus is one of the most experienced providers of workflow automation solutions and technology to the Banking and Financial Services sector.

We have implemented over 350 business process software solutions in this area – including over 200 core processes such as credit and risk approval and customer support processes. Our 90 bank customers span every continent, ever major language, and every bank type including commercial, retail, and Islamic banking - as well as the central banks of 7 nations.

Ultimus ensures that our bank and finance customers realize the enormous benefits of digital business process automation: customer experience, security, compliance, accountability, process visibility, responsiveness, mobility, and cost efficiency. And our proven, industry-leading enterprise level digital automation technologies achieve these benefits with unmatched speed of delivery, reliability, performance, flexibility, and cost effectiveness.

Instead of adapting your business and processes to fit off-the-shelf SaaS applications or engaging in expensive bespoke development and one-off customization, Ultimus has a better way: A proven, industry-leading Digital Process Automation Suite developed for a specific goal – creating a seamless, flexible, connected, digital end-to-end enterprise – quickly, without complexity, and tailored to your exact needs.

Each of the Ultimus DPA Suite’s four key components excels in its category and, together, add up to enterprise-level digital transformation:

Ultimus Composed Process Solutions®(CPS)

Ultimus Composed Process Solutions®(CPS)

Our game-changing low-code application platform that applies modern product line engineering and automated manufacturing principles to deliver and deploy software with unmatched speed, quality, cost, and business value.

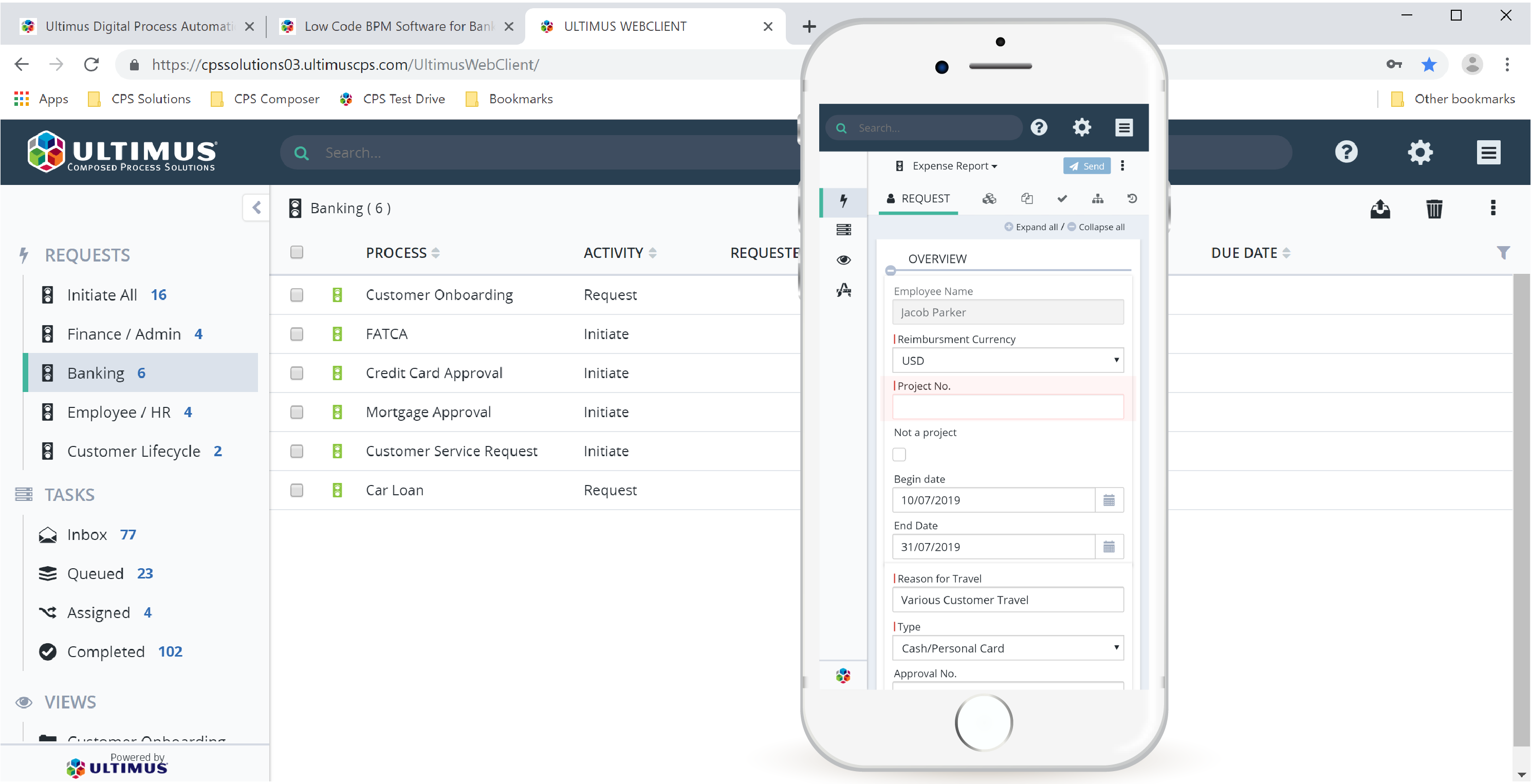

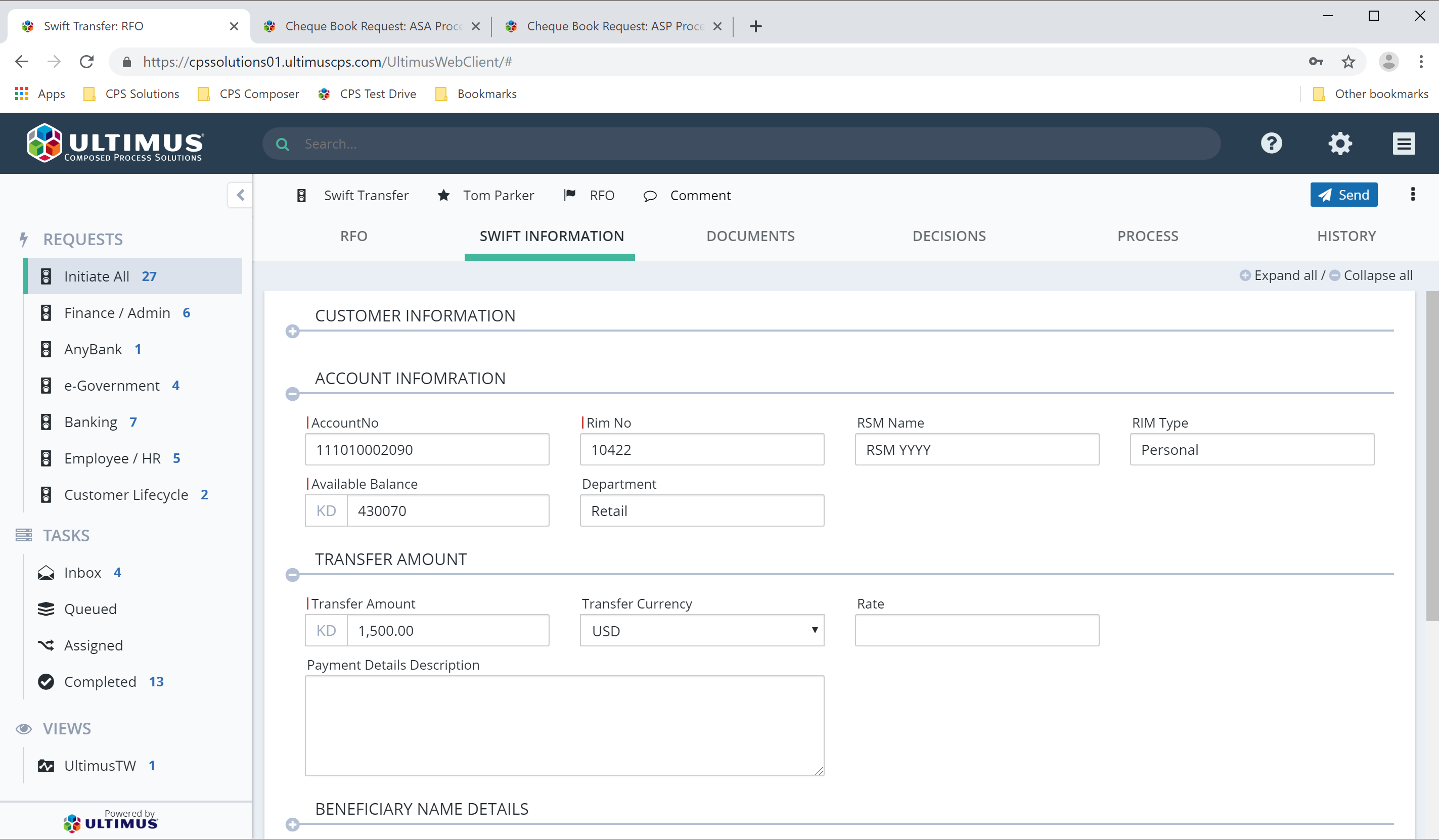

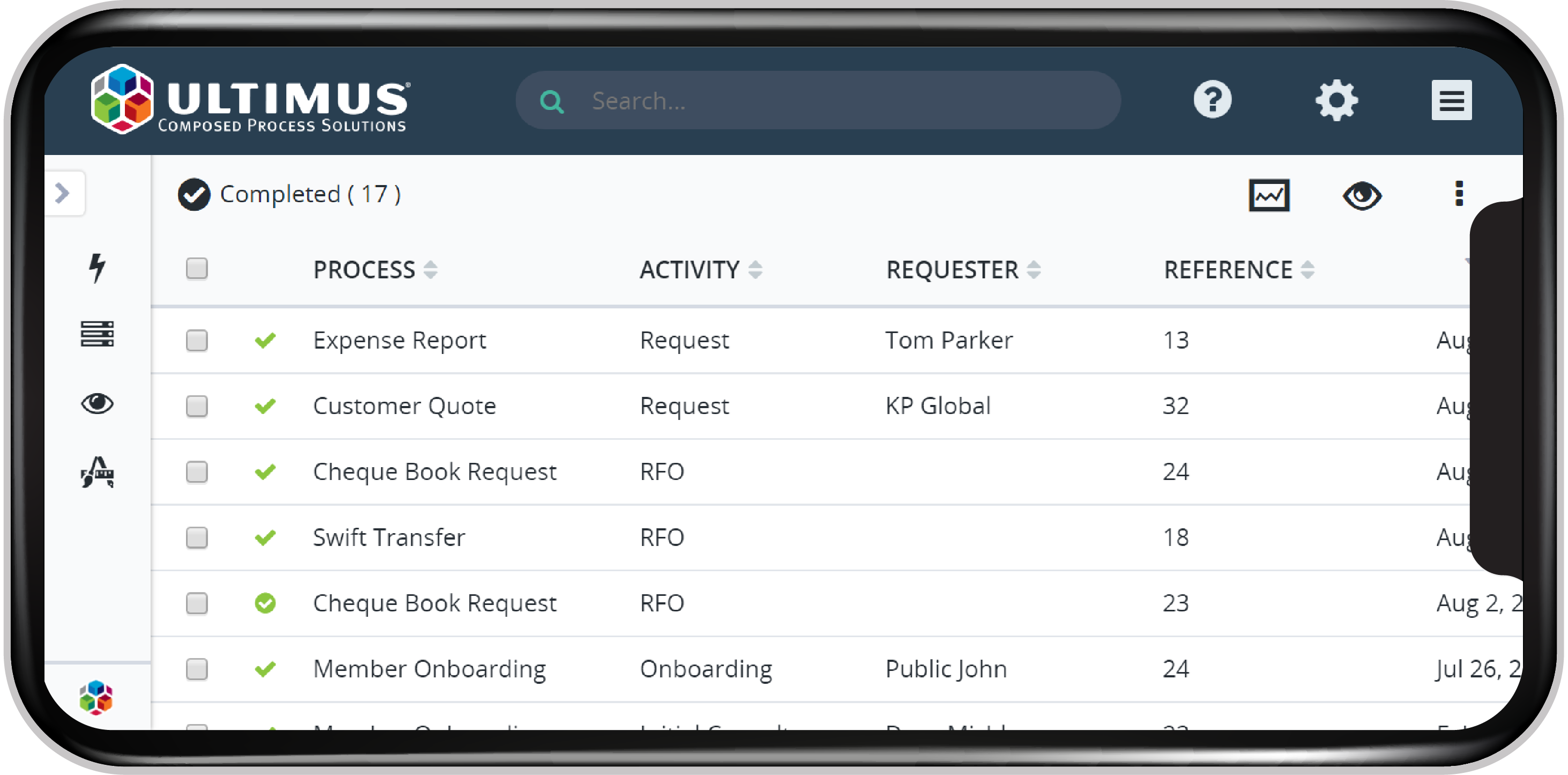

Ultimus DPA Portal and Ultimus Advanced Task Service

Ultimus DPA Portal and Ultimus Advanced Task Service

The only process technology available that ensures in-production solution performance, availability, scalability, and end user productivity and usability.

Ultimus Adaptive BPM Suite

Ultimus Adaptive BPM Suite

Our patented industry leading Business Process Management (BPM) engine, providing the widest range of work routing, notification, escalation, follow-up, and optimization options.

Out-of-the-Box Orchestration of Automation Technologies

Out-of-the-Box Orchestration of Automation Technologies

Pre-integration of technologies such as AI, Natural Language Processing, Blockchain, Decision Management and RPA, that create end-to-end solutions without expensive custom coding.

Solutions by Industry

Professionals like you have shared their experiences with our products

Read Ultimus product reviews on Gartner Peer Insights

Gartner Peer Insights

Reviews from your enterprise peers – verified by Gartner

Ultimus and BDO Announce Partnership for Bank Credit Process Digitization

Digitize your credit process and accelerate your digital transformation.

Join the growing list of Banking and Financial Services companies that have entrusted Ultimus with their mission-critical process automation. Entities such as SAIB Bank, United Bank Limited, RBS Citizens, AXA, Sharjah Islamic Bank, Charles Schwab, Banco National de Costa Rica, Heleba Landesbank, Banco National de Panama, Barclays, SAMA, Arab Bank, Santander, Banesco, and Central Bank of the UAE.

Banking/finance processes automated by Ultimus include:

- Credit Process Digitization

- Retail Credit Approval

- Account Opening, KYC, AML

- Customer Inquiries, Complaints, and Support

- Risk Management

- FATCA and other Regulatory Compliance

- Commercial Loan Approval

- Islamic Banking Processes

- Regulatory Reporting and Oversight

- Collections and Legal Actions

- Discounts, Fee Waivers, and Credit Memos

- Expense Reports and Spending Approvals

- Employee Onboarding

- Policy Document Acknowledgements

- Collateral, Title, and Escrow Processes

Bank Standardizes on Ultimus to Realize Digital Transformation