Download PDF Version

Download PDF Version

Background

Ultimus Client: Not Disclosed

Industry: Banking

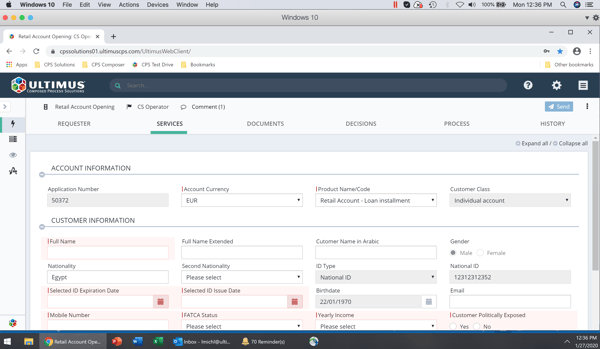

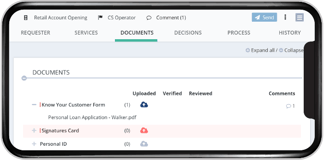

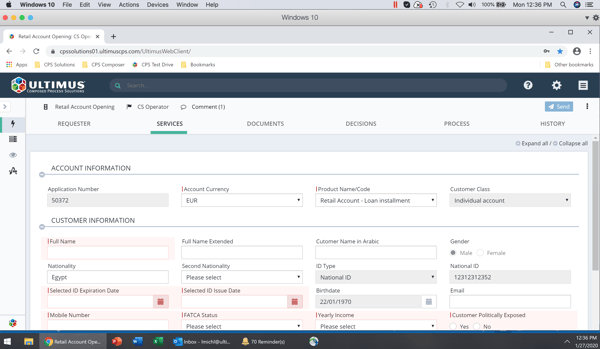

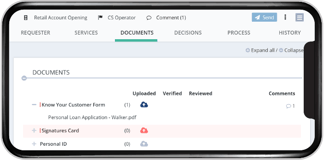

Solution: Customer Care, Retail Finance, Investment Evaluation, Trade Finance, Letters of Credit, and 40+ additional processes

A mid-sized bank offering a broad spectrum of retail, corporate, and investment banking products had recognized that pervasive, seamless, and flexible digital process automation was necessary to optimize operating efficiency and customer experience and, ultimately, to realize strategic competitive advantage.

Challenges and Opportunity

As a multi-product, publicly-traded bank, this customer recognized that large-scale digital process automation and seamlessly connected, globally manageable business processes would eliminate the product and process silos, automation gaps, and business complexity that went along with limited, ad hoc automation.

The customer recognized that digital transformation success required an “industrialized” development approach that would:

- Quickly deliver pervasive automation covering all regional, product, language, and use-case scenarios

- Eliminate expensive one-off customizations and inconsistent implementations

- Minimize cost of ownership through global solutions management, ease of deployment, and intuitive, consistent interfaces across all devices

- Allow business owners to quickly and reliably change key process parameters and business drivers without IT involvement

- Ensure end user performance and up-time as mission critical, customer facing applications scaled to thousands of users

- Leverage complementary automation technologies to create end-to-end solutions

Having automated over 350 banking business processes at 90 banks spanning every continent and concluding that these challenges could not be met with conventional process automation technology, the customer selected the Ultimus Digital Process Automation Suite to digitally transform their operations.

What is the Ultimus Digital Process Automation Suite?

The Ultimus DPA Suite is a comprehensive and tightly-integrated digital business automation platform comprised of Composed Process Solutions, Ultimus’ unique generative low-code application development technology, the patented Ultimus Adaptive BPM Suite, and Ultimus Advanced Task Service, the only technology that ensures the productivity, performance, and scalability of in-production business process applications.

The Ultimus DPA Suite is proven in its ability to meet the most sophisticated enterprise requirements. In addition to its industry-leading business process and production scaling capabilities, its Composed Process Solutions technology allows organizations to create a “software factory” that generates highly sophisticated, tailor-made software applications, 360-degree data views, reports and dashboards, user activity/audit reports, business-user process control interfaces, and integrations with exceptional speed, consistency, and quality.

Unlike other low-code software technologies, CPS uses the same “industrial” principles that have produced order of magnitude improvements in delivery time, quality, and cost in virtually every other industry – except software development. CPS uses (1) a common, standardized architecture and pre-built, interchangeable, and pre-integrated parts; (2) an “ordering” system to specify the requirements of an application or family of applications; and (3) a generator that merges the requirements and domain model in real time when the application is called.

The CPS approach:

- Provides unmatched, multi-level reusability and inherently enforces best practice;

- Ensures that applications are consistent in their construction, implementation and UI; and

- Produces applications that:

- work together, share data, and can be managed as families;

- Function on any device and browser without additional effort; and

- Are easily localizable and adaptable for any use case.

45 Solutions Delivered in 18 Months!

Our customer reported an exceptionally fast time to productivity for users of the Ultimus DPA Suite: After training 5 freshly hired implementers in a little over 2 days, those employees were capable of delivering medium complexity solutions in a average of 2 weeks and complex solutions in about 1 month – including sophisticated integrations to other systems. These critical and core processes are currently in production with over 800 active users.

Based on the speed of delivery, manageability, and consistent, seamless implementation afforded by Composed Process Solutions – as well as the breadth of process capabilities and ability to scale to large numbers of users – this Bank has recognized their ability to achieve their digital transformation goals using the Ultimus DPA Suite and, like many Ultimus customers, has standardized on Ultimus as their sole platform for business process automation.

Key Benefits and Measurable Results

Now in large-scale use, the turnaround time on core credit approval-related processes has been reduced from around 5 days to under 1 day. Additional benefits include:

- Low initial investment and low cost of ownership: Rapid delivery and reusability translate into lower costs;

- Reduced end user training: A consistent, highly intuitive interface with built-in validations and error checking reduced training requirements, support calls, rework, and errors;

- Fast time to productivity: newly hired resources with minimal implementation experience could be trained and deliver complex solutions in around 1 month;

- Greater process visibility: The customer was able to monitor, reduce risk, and ensure compliance with lending standards; and

- Process families that could communicate seamlessly and be managed globally eliminated data islands and duplication of effort while also improving customer satisfaction.