Credit Process Digitization

Ultimus and BDO Germany: Partners for Digital Transformation

Corporate and wholesale banks face a “perfect storm” of stressors that threaten the sector’s very viability. Stubbornly high costs structures, regulation, and unfavorable interest rates have strained profits since the global financial crisis. More recently, rising competition from digitally savvy new entrants and the devastating social and economic impact of the global pandemic put banks at a crossroads: continue with business as usual and risk extinction or move aggressively to gain competitive advantage through digitization.

While previous attempts at digitization have been slow, costly, and of limited scope and value, recent advances in technology have brought digital transformation within the practical reach of every banking institution. Institutions adopting modern digital process automation architectures have experienced dramatically lower operating costs, improved customer responsiveness and experience, and reduced risk – all of which can now be realized in a timeframe and at a cost unimaginable only a few years ago. In short, digital transformation is no longer a risky proposition, but a window of opportunity to be seized while it remains open.

Ultimus, the leader in digital process automation, and BDO AG Wirtschaftsprüfungsgesellschaft, (hereinafter also referred to as ‘BDO’) one of the foremost financial services domain experts, have partnered to provide banks with a fast, cost effective path to digital transformation - one that delivers meaningful ROI in the short term as well as competitive advantage in the longer term.

How We Can Help:

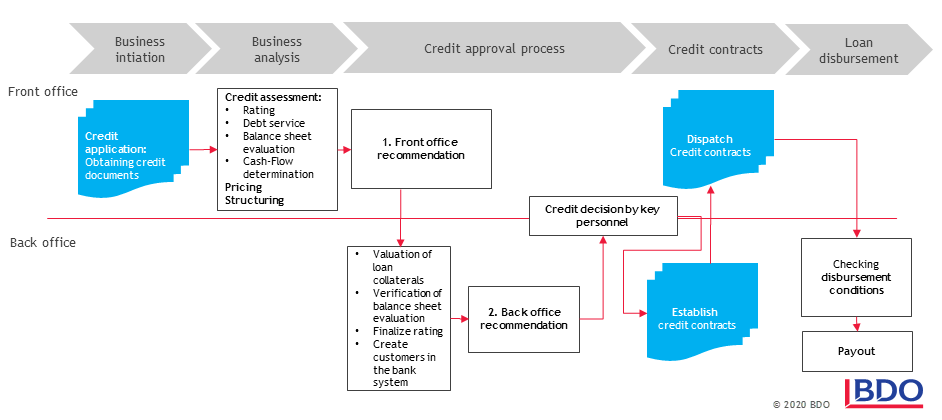

By combining digital process automation and financial domain expertise, the Ultimus/BDO partnership provides its customers with a tailored, end-to-end digitized credit solution that spans credit underwriting, credit monitoring, loan administration, and relationship management - a holistic, end-to-end approach that increases revenue, decreases costs, and mitigates credit risk by:

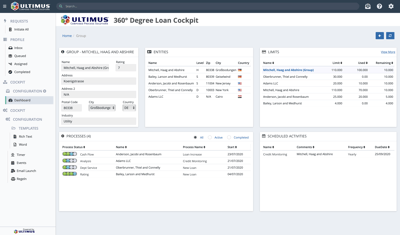

- Consolidating all parent/subsidiary information, processes, notifications, and activities into a powerful 360-degree dashboard – eliminating product, process, and organizational silos and fragmented customer views

- Automating inefficient, manual tasks

- Accelerating approval and account opening turnaround times

- Eliminating irritating, redundant information requests and providing relationship transparency

- Reducing the cost and complexity of regulatory compliance

- Providing visibility into product and customer profitability, risk profiles, and process inefficiencies.

Digitize your credit process and accelerate your digital transformation

Why Ultimus/BDO:

The Ultimus/BDO partnership merges the essential ingredients for successful digital transformation: unparalleled domain expertise and unmatched digital process automation technology leadership.

-

Experience

-

Technology

-

Credit Digitization Framework

With over 1,900 employees across 27 different locations, BDO is one of the leading companies for auditing and audit-related services, tax and business law consulting, and advisory services in Germany.

BDO AG Wirtschaftsprüfungsgesellschaft is a founding member of BDO International (established in 1963). With more than 88,000 employees across 167 countries, it is currently the only globally active auditing and consulting organization with European roots. The BDO financial services experts work with leading banks, investment managers and insurance companies in the major global financial hubs as well as in most other countries in the BDO network on tailored solutions. In addition to its global reach and range of professional services offered, BDO is a leading provider of Fintech and Digital Transformation consulting services to financial institutions.

Ultimus is one of the most established and proven providers of digital process automation technology and services. Widely recognized for its record of technology leadership and innovation, Ultimus is one of the most experienced providers of workflow automation solutions and technology to the Banking and Financial Services sector. Over 90 banks and 7 central banks spanning every continent, major language, and bank type have implemented over 350 business process software solutions with Ultimus – including over 200 core credit approval, risk management, and customer support processes.

Ultimus’ flagship Digital Process Automation Suite is an entirely new concept in business process automation. It is intended to automate an entire business, rather than individual processes, in order to maximize business agility, effectiveness, and efficiency both within the organization as well as with customers, suppliers, and partners outside the organization.

The Ultimus DPA Suite is comprised of Composed Process Solutions, a revolutionary “generative” low-code BPM application development environment, the patented Ultimus Adaptive BPM Suite, and Ultimus Advanced Task Service, the only technology that handles the operational issues encountered in high-volume, mission critical process environments.

The Ultimus DPA Suite is a “software factory” for digital process automation, producing highly sophisticated, tailor-made software applications, 360-degree data views, reports and dashboards, user activity/audit reports, business-user control User Interfaces, and integrations with exceptional speed, consistency, and quality.

But digital transformation requires more than speed of delivery, it requires a new, modern architecture purpose-built to meet the demands of the digital enterprise. Ultimus-based solutions inherently work together, share data, and can be managed as families; function on any device and browser without additional effort; and are easily localizable and adaptable for any use case.

Ultimus and BDO have created the Credit Digitization Framework, a collection of pre-built reusable digital assets and capabilities; solution fragments; and process, report, and dashboard templates that can be composed and recomposed to create a seamless, agile, and fully digitized credit function tailored to the exact needs of each bank.

The Credit Digitization Framework:

Quickly unlocks measurable business value in a core function, bringing savings that make future transformation efforts self-funding

Quickly unlocks measurable business value in a core function, bringing savings that make future transformation efforts self-funding- Provides a consolidated, 360-degree relationship view/dashboard for both employees and customers

- Aggregates all process and product interactions to eliminate tedious, time-consuming, and redundant client information requests, improve data quality, and speed turnaround times

- Automatically triggers process launches and escalations based on definable, dynamic rules, events, and thresholds

- Extends private, secure process participation and self-service to clients, allowing all stakeholders to share in the benefits of digitization

- Establishes a holistic digital architecture to accelerate seamless, coordinated end-to-end digitization across the business.